The power of the core-satellite investing strategy

Discover why having a core-satellite approach to your portfolio is a powerful investment tool. What is a core-satellite strategy and why is it so powerful?

Discover why having a core-satellite approach to your portfolio is a powerful investment tool. What is a core-satellite strategy and why is it so powerful?

If you have more than one loan, it may sound like a good idea to roll them into one consolidated loan. Debt consolidation (or refinancing)

Key takeaways Insight into the various pros and cons of each of the three main options for your retirement savings – account-based pension, lump sum,

Tax breaks are always good news, but for house hunters they can have an added bonus. Not only do tax cuts mean potential buyers have

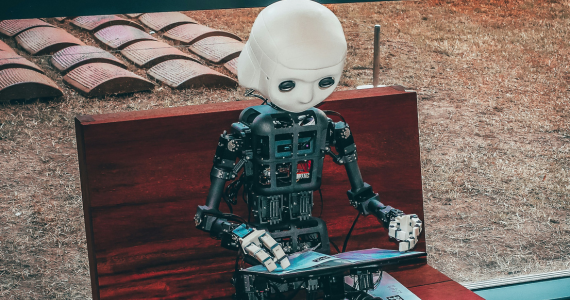

Key takeaways How Artificial Intelligence (AI) is currently being used to shape investment decisions, with applications such as sentiment analysis and algorithmic trading. The AI

As our family members or friends get older, it’s normal to worry about them and want to help. But it’s not that easy to know

Teaching kids about money The truth is, adulthood is rife with financial challenges. The more prepared your children are, the better. From budgeting and saving,

The super changes from the start of the 2024-25 financial year. A number of superannuation changes came into effect on 1 July 2024 and are

With less than a month to go before the end of the financial year (EOFY) rolls around, some important tasks need to be completed for

Rather than worrying about day-to-day price movements, focus here instead. If you checked on the status of your investment portfolio today, don’t worry. You’re definitely

The rules around making some types of super contributions have been relaxed in recent years, so it’s worth exploring the different opportunities available to you

Key takeaways From 1 July 2024, the SG rate which determines the minimum percentage of your salary that your employer must contribute to your super

PO Box 187, Miranda NSW 1490

Roblex Donlan Pty Ltd acn 140 389 948 as trustee for Strive Family Trust ABN 30 039 553 070 trading as; Strive Wealth Solutions is an Authorised Representative of Consultum Financial Advisers Pty Ltd ABN 65 006 373 995, AFSL number 230323, an Australian Financial Services Licensee, with offices at Level 6, 161 Collins Street, Melbourne VIC 3000.

This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.

Any advice on this site is general nature only and has not been tailored to your personal objectives, financial situation and needs. Please seek personal advice prior to acting on this information. Any advice on this website has been prepared without taking account of your objectives, financial situation or needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your objectives, financial situation or needs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.